Recap of Little Tokyo Community Impact Fund’s South Bay Kick Off

Over 40 Little Tokyo stakeholders filled the hall of the Gardena Valley Japanese Cultural Institute last Saturday, November 16, 2019 to discuss a new community development strategy emerging from the Japanese American community: the Little Tokyo Community Impact Fund (LTCIF).

The meeting began with a short film by Robert Shoji titled “Gone” which interrogates the question: “Will we stand by until Little Tokyo is GONE, or will we stand up and fight for the future of our community?” Familiar images and shots of Little Tokyo’s cultural institutions, small businesses and community spaces juxtaposed with cranes, “for lease” signs and closed storefronts.

Shoji’s film set the tone of the event’s purpose: to evoke a call to action to protect Little Tokyo from the changing landscapes fueled by gentrification and rising rents that put long-time residents, small businesses and community spaces at-risk of displacement and cultural erasure.

With the Metro regional connector currently being built in Little Tokyo, there are concerns over rising rents and property values within the next two years. LTCIF is a community-driven real estate investment fund with the purpose to purchase and manage properties in Little Tokyo. The Fund as a social purpose corporation, is a new tool aimed to support heritage-based businesses and properties in Little Tokyo and will work alongside other anti-displacement strategies that are currently being used. The idea is to attain community control over properties in the area and provide below market rates to businesses, cultural institutions, spiritual centers, and other enterprises, consistent with the social purpose of the Fund.

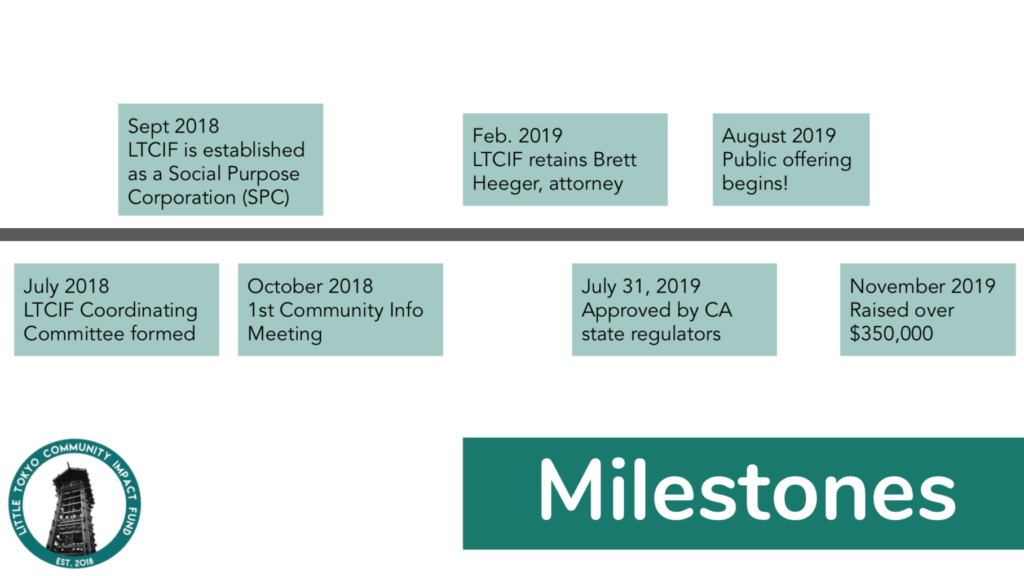

It has been over a year since LTCIF was first introduced to the South Bay community. When LTCIF President, Bill Watanabe, asked “Who came to last year’s meeting?” over half the room raised their hands. The Fund’s organizing committee worked with lawyer Brett Heeger to solidify the Fund’s purpose, structure and investment options. According to Watanabe, the Fund has grown significantly over the past months:

- On July 30, 2019 the Commissioner of the California Department of Business Oversight officially recognized the Fund—allowing LTCIF as a social purpose corporation to sell two classes of shares directly to California residents: Class A which requires a purchase of $1,000 for one share and Class B which requires a minimum of purchase of $10,000 for two shares (with each share costing $5,000).

- The Fund has until July 31, 2020 to reach a minimum subscription $500,000. LTCIF has more than 25 investors who have invested over $350,000 in shares. Once the Fund reaches $450,000, we have a commitment of a $50,000 from a prospective investor to help us reach the minimum.

- LTCIF will be looking to investors to elect a Board in the upcoming months. Class A shareholders get ⅓ of the seats on the Board while class B investors get ⅔.

- The Fund is researching sites in Little Tokyo that can be served through the Fund’s purpose.

“You’re sitting here because I think you’re more interested not in the highest return but putting money to work that’s going to benefit the community, at the same time you’ll get something on your investment” shared Bill Watanabe.

LTCIF committee member, Casey Nishizu, introduced several scenarios of how the Fund can be used to purchase real estate in Little Tokyo. Graphics showing increases in market rents and vacancies reiterated the urgency to get community control of these properties in the neighborhood.

“What is Little Tokyo?” a video by Steve Nagano closed the event program which reminded attendees how many families got their start in Little Tokyo. The neighborhood has also evolved into a place where visitors can learn about Japanese American history and culture, but also be patrons of unique small businesses, religious institutions, museums and community art spaces—all of which are worth preserving, especially for future generations.

An in-depth Q&A segment took place that dug deep into the Fund’s structure and investment options. Some of this discussion is captured on LTCIF’s FAQ page: https://littletokyocif.com/invest/faqs/.

The Q&A also brought about a sharing of personal experiences and testimonies as to why it is important to take action. One attendee commented, “I grew up going to Chinatown…my parents used to buy groceries there. And now Chinatown has become this hipster destination. It has evolved into something I hardly recognize from my childhood…I admire the Japanese community for even conceiving doing something like this. I applaud this effort.”

Although this is a new tool to engage stakeholders to invest in the area, LTCIF investor Steve Nagano shared that the practice is actually very familiar: “the concept is not new to our community, the Tanomoshis, Keiro, Little Tokyo Towers, Gardeners’ Federation (and building) were all built by a cooperative effort, people contributing their part for the greater community. The difference today is the mechanism (an investment fund). As the Nisei generation pass and the Sansei age, I feel we have a duty, an obligation, to them to do our best to keep Little Tokyo.”

“Let’s build something together greater than what I can do as an individual…there are many examples in our community of where we’ve pulled our money together to build something for the whole…” remarked Steve Nagano. Investors like Alan Nishio also shared the importance of preserving Little Tokyo in order to be a model for future generations: “This is what we’ve passed on to you…We expect you to carry it on.”

All attendees were given a Prospectus, the Offering Circular (or Memorandum) that details the Fund’s plan, structure, risks, and more. It also includes important eligibility requirements for each class of shares. One-on-one consultations and networking commenced after the Q&A.

Prospective investors are invited to request an Offering Circular on LTCIF’s website: https://littletokyocif.com/invest or even request presentations for their respective community organizations and groups. The Fund also welcomes volunteers who can share their expertise on community outreach, marketing, finance and real estate. For more information, you can contact the Fund at info@littletokyocif.com.